Intel report record revenue and profit figures

Ryan Martin / 13 years ago

Intel Corporation today reported third-quarter results, setting new records for microprocessor units shipped, EPS, earnings and revenue, which was up 28 percent year-over-year.

“Intel delivered record-setting results again in Q3, surpassing $14 billion in revenue for the first time, driven largely by double-digit unit growth in notebook PCs,” said Paul Otellini, Intel president and CEO. “We also saw continued strength in the data center fueled by the ongoing growth of mobile and cloud computing.”

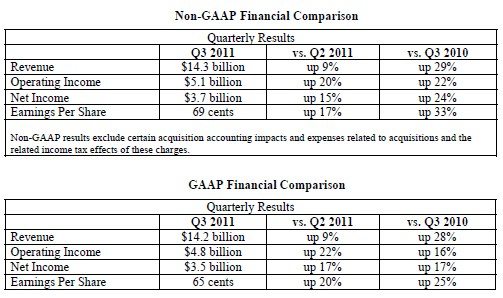

On a Non-GAAP basis, revenue was $14.3 billion, operating income was $5.1 billion, net income was $3.7 billion and EPS was 69 cents. On a GAAP basis, the company reported third-quarter revenue of $14.2 billion, operating income of $4.8 billion, net income of $3.5 billion and EPS of 65 cents.

The company generated approximately $6.3 billion in cash from operations, paid cash dividends of $1.1 billion, and used $4.0 billion to repurchase 186 million shares of common stock. Intel’s board of directors also voted to increase the company’s buyback authorization by $10.0 billion, raising the total unused balance to $14.2 billion at the end of the third quarter. The company also completed a senior notes offering of $5.0 billion primarily for the purpose of repurchasing stock.

Q3 2011 Key Financial Information (GAAP)

Business unit trends:

- PC Client Group revenue of $9.4 billion, up 22 percent year-over-year.

- Data Center Group revenue of $2.5 billion, up 15 percent year-over-year.

- Other Intel architecture group revenue up 68 percent year-over-year.

- Intel Atom microprocessor and chipset revenue of $269 million, down 32 percent year-over-year.

- McAfee Inc. and Intel Mobile Communications contributed revenue of $1.1 billion.

- The platform average selling price (ASP) was up year-over-year and flat sequentially.

- Gross margin was 63.4 percent, 0.6 percent below the midpoint of the company’s expectation.

- R&D plus MG&A spending was $4.2 billion, slightly below the company’s expectation.

- Net gain of $107 million from equity investments and interest and other, consistent with the company’s expectations of approximately $100 million.

- The effective tax rate was 29 percent, above the company’s expectation of approximately 28 percent.

- The company used $4.0 billion to repurchase 186 million shares of common stock.